The Marker: 5 Cases Involving Motti Gruzman and Excelion

"It appears that the debtor [Gruzman] is allegedly ignoring his debts, violating his commitments in the agreement, and seeking to avoid paying his debt. Under these circumstances, delaying the debtor in Israel to ensure the repayment of his debt is proportionate and reasonable. I am convinced there is a real concern that the debtor is acting to transfer assets, and his absence from the country will significantly hinder the creditor's ability to enforce the judgment and collect the debtor's debt, should it be determined." Honorable Judge Mika Banki

1. Dream View, Pamporovo, Bulgaria

The company led by Gruzman promised apartment buyers in the project that the apartments would be delivered ready after a comprehensive renovation, including a spa, parking lot, and public areas by September 2022. In the summer of 2023, Dream View investors received an update that the renovation was completed and the apartments were ready for delivery. However, upon delivery, it was revealed that: the apartments were of low finishing quality, some lacked sanitary fixtures, beds, the spa was just exposed concrete walls and flooded with water, the parking lot had no electricity, was also flooded with water, and the hotel could not be operated in its physical state. The elevator and the staircases were disconnected because the developer did not pay for them. After months of delays from Gruzman to complete the project, the apartment buyers' committee decided to work directly with the Bulgarian management company. They seized Gruzman's assets in the project through a Bulgarian lawyer to realize the assets and complete the project.

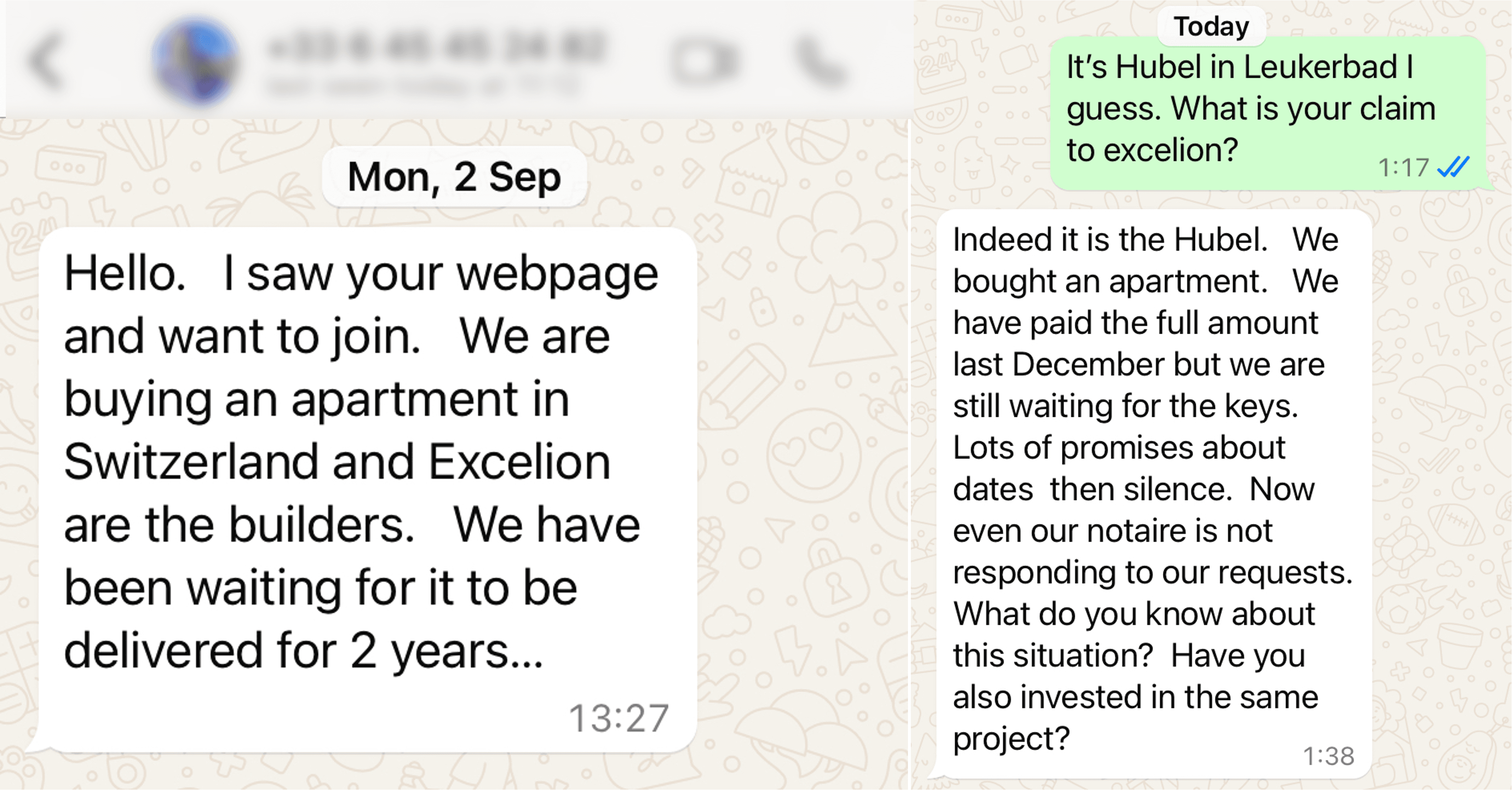

2. Bruck, Zell am See, Austria

The group that invested in 2017 in Excelion's apartment hotel project near the ski resort in Bruck near the Zell am See ski resort in Austria received an email from their Austrian lawyer in January 2024: the project's property, where they purchased apartments, was sold in May 2023 to a third party as part of a receivership process. Gruzman's company had promised to transfer the apartments to the buyers by December 2017. From time to time, Gruzman updated the buyers on bureaucratic difficulties, including obtaining a building permit, financing issues, problems due to the COVID-19 period, and more. However, the buyers believed their money was protected through the collateral they received and trusted Gruzman. "The project is excellent, prices have risen," Gruzman wrote to the apartment buyers in January 2023, when their property was already in the bank's receivership process that provided the mortgage for the project. "The project indeed took much longer than expected, but it is a good project and will start very soon." The buyers filed a lawsuit in February this year against Gruzman, his wife Deborah, and their companies for NIS 3.6 million. The plaintiffs accused Gruzman of fraud in the statement of claim. In the defense statement, the defendants referred to the buyers' claims as "outrageous." "Gruzman worked for the success of the project, and the plaintiffs' accusations trying to tarnish his name when the risky project failed are infuriating," it stated. The parties are currently negotiating to settle the legal proceedings outside the court.

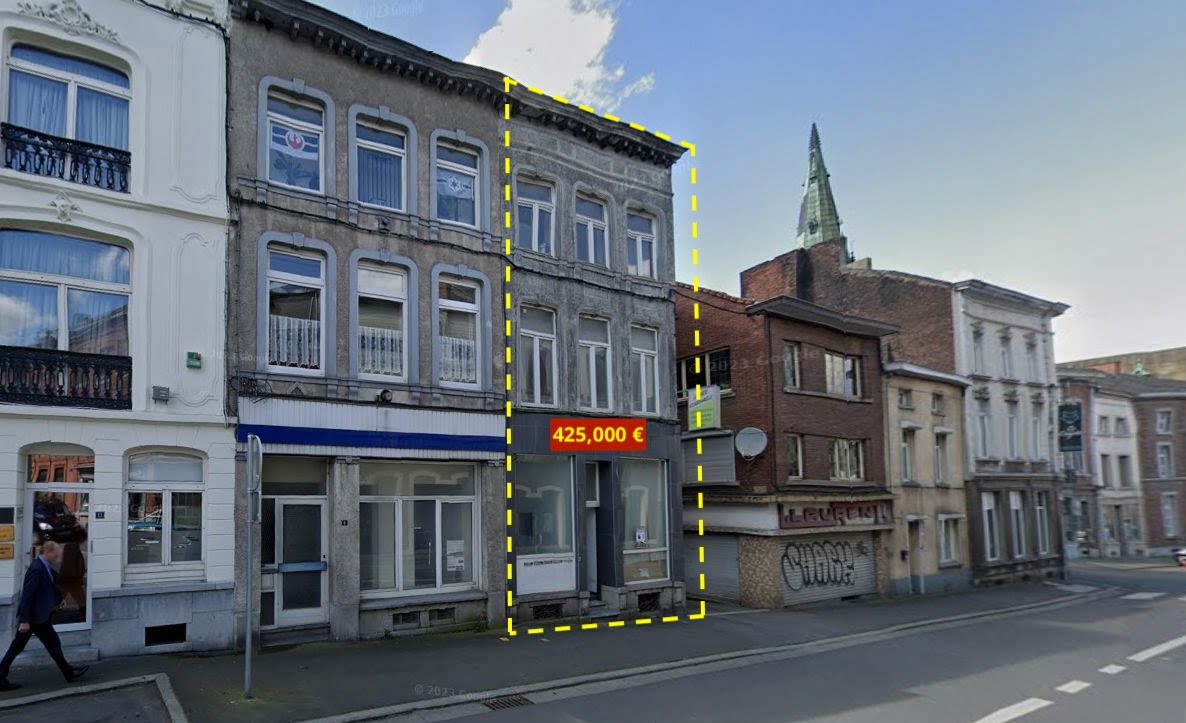

3. Sankt Martin, Austria

In 2016, Gruzman began marketing his project in Sankt Martin, in the Salzburg area. About 50 buyers in the project who paid around 50% of the apartment price received a direct right in the property, either ownership or a warning note. Gruzman then made a good impression on them as a responsible person working with reliable professionals, and the projects seemed promising and profitable. In 2018, the project was delayed: some renovation works were indeed carried out, but construction on the project stopped because the project company ran out of money. The contractor demanded another €5.5 million. Gruzman's impression also changed: "We would agree on something in the stuck project, reach agreements and financial solutions, and then a few days later, I would receive an email from him reneging on the agreements." These days — seven years after the purchase and six years after the properties were supposed to be delivered to the buyers — Excelion still hasn't reached agreements with the project's buyers, and most have already given up. Excelion offered the apartment buyers in the project several options: 1) to exchange their right in the apartments in this project with rights in another Excelion project in Bulgaria, or 2) to buy their properties for 70% of the investment and lose 30% of it. For some buyers, such offers mean shelving their investment. One buyer who signed an agreement for about €84,000 said he wanted to purchase the apartment in Sankt Martin because he understood that he and his family could live there for about a month a year. He rejected the offer to switch to Bulgaria because, according to him, checks he made found it unprofitable.

4. Andorra

Dr. Ehud Berg, who separately sued Gruzman and the companies over the project in Bruck, loaned €700,000 in January 2018 for another Gruzman project in Andorra. In October 2019, he filed a lawsuit in the Central District Court demanding that Gruzman and the Spanish company repay the loan. In 2021, the parties reached a settlement approved by the court, under which Gruzman would repay Berg NIS 3.2 million.

5. Loan from "Value Loans Properly"

In September 2018, the "Value Loans Properly" company granted a €1 million loan for two years to a Gruzman company with his personal guarantee. The loan was supposed to be repaid in June 2020. From time to time, the companies extended the loan repayment date. At some point, Gruzman gave the lending company a check for NIS 1 million for August 2022. The lending company tried to cash the check, but it was not honored. They went to the execution office, and Gruzman tried to oppose the process by going to court. Judge Mika Banki of the Jerusalem Magistrate's Court ruled that

"it appears the debtor is allegedly ignoring his debts, violating his commitments in the agreement, and seeking to avoid paying his debt. Under these circumstances, delaying the debtor in Israel to ensure the repayment of his debt is proportionate and reasonable."

"I am convinced there is a real concern that the debtor is acting to transfer assets, and his absence from the country will significantly hinder the creditor's ability to enforce the judgment and collect the debtor's debt, should it be determined."

The case returned to the execution office.